How Property Taxes Work

Washington state property tax is complicated! As East County Fire and Rescue is largely funded by property taxes it is essential to understand how the property tax system functions and the impact of its complex and interrelated limits.

Types of Tax Levy

There are several types of property tax levy, simply classified into the regular levy and excess levies. The regular levy comprises the property taxes that support general operations. Excess levies are separate from the general levy and not subject to the same constitutional and statutory limitations as they are approved by the voters.

Property Tax Components

There are three main components that determine property tax in Washington state:

- Levy Amount: The total amount of tax to be collected from taxpayers by a taxing district (such as East County Fire and Rescue).

- Assessed Value (AV): One hundred percent of its true and fair market value in money, according to the highest and best use of the property. Fair market value, or true value, is the amount of money that a willing and unobligated buyer is willing to pay a willing and unobligated seller.

- Levy Rate: This rate is expressed in terms of a dollar rate per $1,000 of assessed valuation and is determined by dividing the levy amount by the assessed value (in thousands of dollars).

From here, things get a bit more complicated. The property tax levy is constrained by the overall limits on the regular levy rate and the limit on annual levy increases.

Constitutional Levy Rate Limits

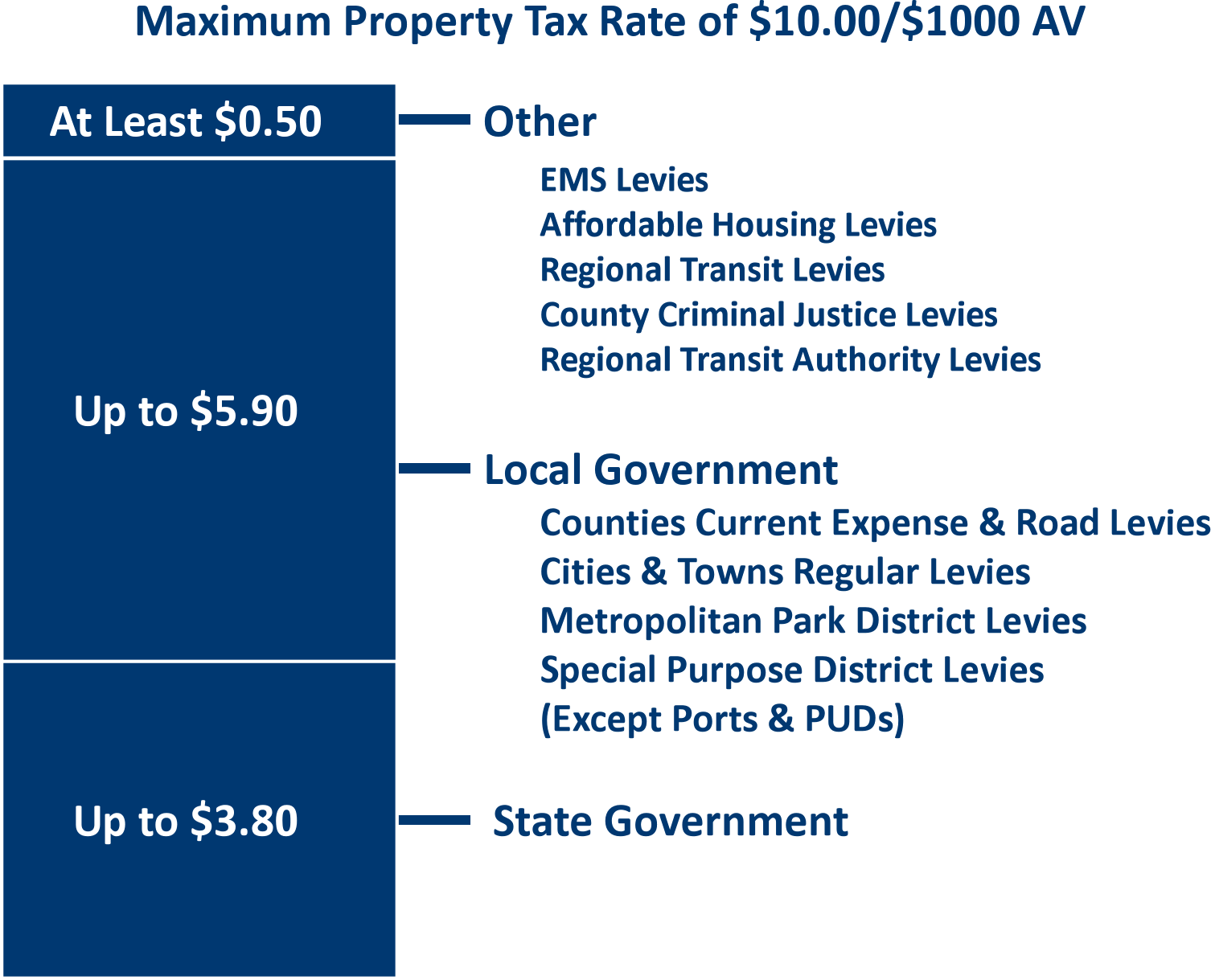

The Washington Constitution limits the total annual property tax rate for regular levies to one percent of its true and fair market value. As levy rates are expressed in terms of dollars per $1,000 AV, one percent is the same a $10/$1,000 AV and is often referred to as the ten-dollar limit. This ten-dollar limit is allocated between the state and local governments

Local government is divided into senior taxing districts such as counties, cities and towns, and road districts who get priority in levying the $5.90/$1,000 assessed valuation (AV) and junior taxing districts who have second priority. Counties have a maximum levy of $1.80/$1,000 AV for the general fund and $2.25/$1,000 AV for a road levy (in unincorporated areas). Cities have a maximum levy of $3.375/$1,000 AV. Public utility and port districts are senior taxing districts that are not subject to the $5.90 limitation.

If the combined levy exceeds $5.90/$1,000 AV, the junior taxing districts must reduce their levy to meet the local government $5.90/$1,000 AV limit. This is a process defined in the Department of Revenue Property Tax Levies Operations Manual and Washington Administrative Code (WAC) 458-075. Special districts also have levy limits. For example, fire districts have a maximum regular levy rate of $1.50/$1,000 AV and there is a maximum levy rate for emergency medical services of $0.50/$1000 AV that may be levied by a special district or by cities and towns.

Constitutional Levy Increase Limit

In addition to limits on the overall levy rate, there is a one percent limit on the amount an individual taxing district can increase the property tax levy (total amount of taxes) each year. For example, if a taxing district levied $1,000,000 in the current year, next year’s lawful levy would be $1,010,000 (an increase of one percent). However, the taxing district can also levy taxes on property that was added to the tax rolls in the prior year, such as a newly constructed house (RCW 84.55.010) or property that has been annexed (WAC 458-19-035). So, in many cases, the levy increases by more than one percent due to the value of new construction.

Calculating the Property Tax Levy Rate

One of the confusing aspects of Washington state property taxes is that the levy rate can change over time based on the authorized levy and the total assessed value of property within the jurisdiction. Consider the following scenarios.

A taxing district may increase their levy by one percent each year, but the total assessed value within the district may stay the same, it may increase, or it may decrease. If the total assessed value remains the same and the authorized levy increases by one percent, the levy rate will also increase by one percent (if it is below the statutory maximum levy rate for the type of taxing district). If the total assessed value within the district increases by one percent, the levy rate would remain the same and if the total assessed value increases by more than one percent, the levy rate would decrease so that the district would receive no more than its lawful levy. On the other hand, if the assessed value decreases, the levy rate will increase to provide the taxing district with its lawful levy (if it is below the statutory limit for the type of taxing district. Consider the following simplified example of how changes in AV impact the levy rate.

Lid Lift

For a taxing district to increase the property tax levy by more than one percent, a proposed lid lift must be presented to the voters within the district. Lid lifts can be for a single year or up to six years and may be temporary or permanent. Passing a lid lift requires that a majority (50% plus one) of the taxing district’s voters approve the ballot measure.

Excess Levies

Excess levies for maintenance and operations, construction, or payment of debt service on bonds are not subject to the same limitations as the general levy but are subject to the taxing district’s statutory limit on indebtedness (which for fire districts such as East County Fire and Rescue is three fourths of one percent of the value of taxable property within the district (RCW 52.16.080)). Ballot measures for excess levies must be passed by a supermajority (60%) and must be validated with an election turnout of 40% of the number of voters in the last general election.